Discover our AML solutions, tailored to your needs.

Are you prepared for the Money Laundering Regulations 2017?

Are you prepared for the Money Laundering Regulations 2017?

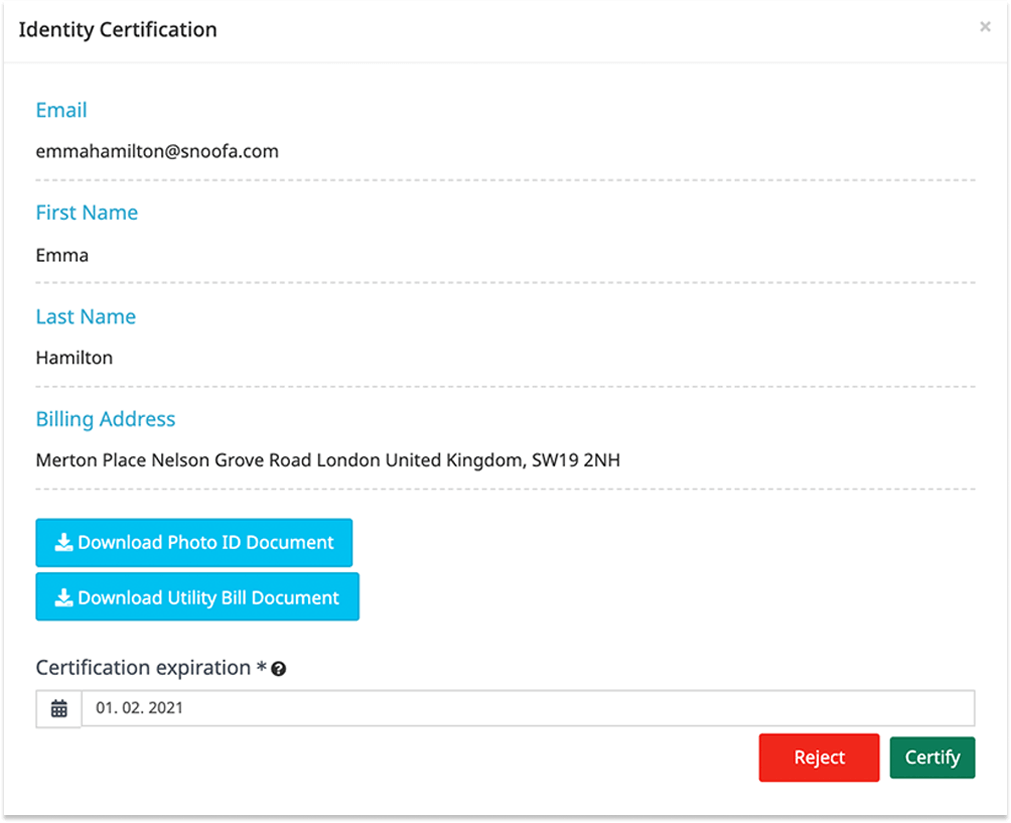

From 10th January 2020, Art Market Participants and Auction Houses who offer Works of Art for sale over the threshold of 10,000 Euros (or its equivalent currency), must comply with the Money Laundering Regulations 2017. As part of their legal obligation under the legislation they must register with HMRC for AML supervision by 10th June 2021. Snoofa is delighted to be working with FCS Compliance to provide our clients with a complete solution and peace of mind.

Snoofa has developed a suite of fully compliant AML registration options for our tenants. Together with expertise provided by FCS Compliance, you can access a complete affordable solution.